Majority support for easing of credit restrictions

29 April 2025

Credit restrictions in the housing market have long been a debated topic – and this spring, the Government is expected to revisit potential relaxations. The proposals have both supporters and critics, but a new survey from Hemnet shows that homebuyers are generally positive towards the discussed changes.

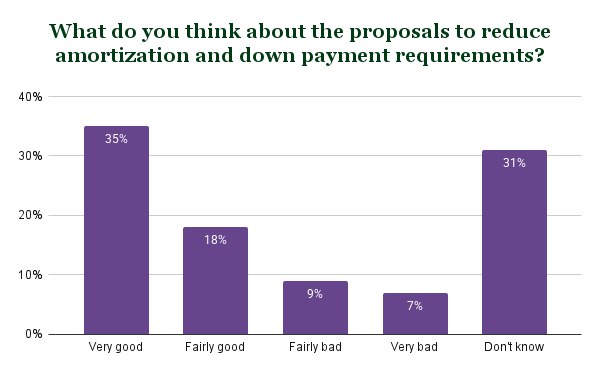

Among the respondents on Hemnet, 53 percent consider the proposals to be fairly or very good. Just under a third (31 percent) are uncertain, while 16 percent believe the proposals are fairly or very bad.

Although a common concern regarding easing credit restrictions is that it could drive up housing prices, few see rising prices as the main advantage. Only 5 percent of those who are positive about the proposals cite this as their primary reason. Instead, the most common reason for viewing the changes positively is that it would make it easier to buy a home in the future – 45 percent in the positive group state this as their reason.

Among those who are negative towards the proposals, rising prices are the primary concern. Of the negative respondents, 37 percent mainly oppose the proposals because they believe prices will increase.

The survey also differentiates between responses based on whether the individual plans to buy a home within the next 12 months or not. Some differences are observed: Those not planning a purchase are more likely to be uncertain about whether the proposals are good or bad. This group is also somewhat more skeptical overall – although even here, the share of positive respondents is more than twice as large as the share of negative ones.

Erik Holmberg, Market Analyst at Hemnet, comments:

"There are both advantages and disadvantages to easing credit restrictions, although the majority generally seem positive towards a change. Regardless of the political direction chosen, it is crucial that a decision is made within a reasonable timeframe. We have previously seen how these kinds of regulatory changes affect people's willingness to act in the market. It creates speculative behavior where moving decisions are based more on tactical considerations than actual needs – something that in the long run is negative for both the housing market and society as a whole."

About the Survey

The survey was conducted on Hemnet.se between April 3 and 5, 2025, with 2,275 respondents.

Questions and Results:

Are you planning to buy a home within the next 12 months?

Yes: 43%

No: 57%

What is your opinion on the proposals to reduce amortization requirements and down payment requirements for financing a home purchase?

Very good: 35%

Fairly good: 18%

Fairly bad: 9%

Very bad: 7%

Don't know: 31%

What is the main reason you view the reduced amortization and down payment requirements positively? (Asked to those who answered fairly or very good)

It will make it easier for me to buy a home in the future: 45%

It will make it easier for me to sell a home in the future: 14%

I believe it will lead to higher home prices: 5%

It will create a better housing market: 27%

Other reason: 5%

Don't know: 4%

What is the main reason you view the reduced amortization and down payment requirements negatively? (Asked to those who answered fairly or very bad)

It will make it harder for me to buy a home in the future: 3%

It will make it harder for me to sell a home in the future: 0%

I believe it will lead to higher home prices: 37%

It will create a worse housing market: 24%

Other reason: 30%

Don't know: 6%

For more information, please contact:

Press enquiries

Erik Holmberg, market analyst Hemnet

M: +46 72-55 88 050

E: [email protected]

Staffan Tell, Head of PR

M: +46 733 67 66 85

E: [email protected]

About Hemnet

Hemnet operates the leading property platform in Sweden. The company emerged as an industry initiative in 1998 and has since transformed into a "win-win" value proposition for the housing market. By offering a unique combination of relevant products, insights and inspiration, Hemnet has built lasting relationships with buyers, sellers, and agents for more than 20 years. Hemnet shares a mutual passion for homes with its stakeholders and is driven by being an independent go-to-place for people to turn to for the various housing needs that arise through life. This is mirrored in the company’s vision to be the key to your property journey, supplying products and services to improve efficiency, transparency and mobility on the housing market. Hemnet is listed on Nasdaq Stockholm (‘HEM’).

Follow us: hemnetgroup.com / Facebook / LinkedIn / Instagram