Homebuyers welcome eased mortgage rules

6 February 2026

As of 1 April this year, changes to Sweden’s mortgage lending restrictions are planned. The mortgage cap is set to be raised and the stricter amortisation requirement removed. A new survey from Hemnet now shows that this will affect a large share of those planning to buy a home going forward.

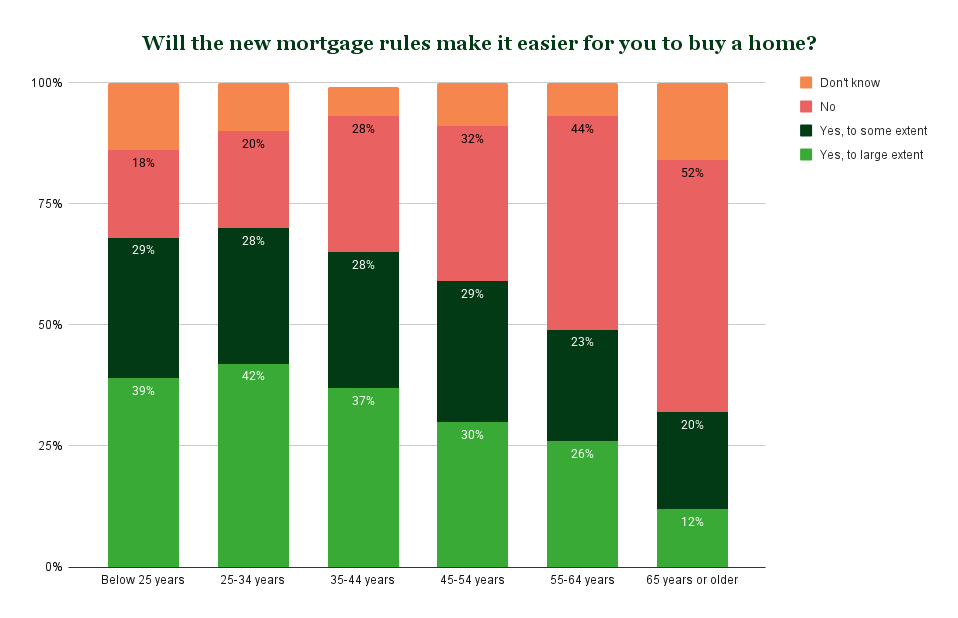

In a survey conducted in January, homebuyers on Hemnet were asked whether the revised mortgage rules would make it easier for them to purchase a home. Six in ten respondents said the new mortgage rules would make it easier when buying a home.

A buyer’s age generally has a major impact on whether they say the changes will make it easier to buy a home. Among those aged 65 or older, more than half (52%) say it will not make it easier.

The age group most likely to say the changes will help them buy a home is 25–34. In this group, seven in ten say it will become easier, and 42% say it will make things significantly easier.

Homebuyers are also broadly positive about the changes overall. Among respondents, 76% are very or fairly positive about the eased credit restrictions. And even though only 32% of homebuyers in the 65+ group say the changes will make it easier for them, three in four (75%) are still positive about the change.

Erik Holmberg, Market Analyst at Hemnet, comments:

“The eased mortgage rules will make it easier for many to finance their home purchase. That is fundamentally positive, as more people can move to a home where they want to live. At the same time, increased purchasing power—everything else being equal—puts upward pressure on house prices, which in the longer term can lead to both higher prices and higher interest costs. We are already seeing effects of the upcoming regulatory changes: buyers’ motivation to act has increased, while many sellers would rather wait until the changes have actually taken effect.”

| Will the new mortgage rules make it easier for you to buy a home? | ||||

| Age of homebuyer | Yes, to large extent | Yes, to some extent | No | Don’t know |

| Below 25 years | 39% | 29% | 18% | 14% |

| 25 till 34 years | 42% | 28% | 20% | 10% |

| 35 till 44 years | 37% | 28% | 28% | 6% |

| 45 till 54 years | 30% | 29% | 32% | 9% |

| 55 till 64 years | 26% | 23% | 44% | 7% |

| 65 years or older | 12% | 20% | 52% | 16% |

| Total | 31% | 27% | 33% | 9% |

| Do you think it is a good idea to reduce the down payment requirement and remove the stricter amortisation requirement? | ||||

| Age of homebuyer | Yes, very good | Yes, fairly good | No, fairly bad | No, very bad |

| Below 25 years | 39% | 35% | 20% | 6% |

| 25 till 34 years | 45% | 28% | 18% | 10% |

| 35 till 44 years | 46% | 31% | 14% | 9% |

| 45 till 54 years | 48% | 30% | 11% | 11% |

| 55 till 64 years | 43% | 34% | 16% | 8% |

| 65 years or older | 43% | 31% | 18% | 9% |

| Total | 45% | 31% | 15% | 9% |

The survey was sent to 3,162 visitors to hemnet.se between 9 and 13 January.

För mer information, kontakta:

Kontaktperson

Erik Holmberg, marknadsanalytiker Hemnet

M: +46 72-55 88 050

E: [email protected]

Om Hemnet

Hemnet driver Sveriges ledande bostadsplattform. Bolaget grundades som ett branschinitiativ 1998 och har sedan dess utvecklats till en värdeskapande marknadsplats för bostadsmarknaden. Genom att erbjuda en unik kombination av produkter, insikter och inspiration har Hemnet byggt varaktiga relationer med köpare, säljare och fastighetsmäklare i över 25 år. Hemnet delar tillsammans med sina målgrupper en gemensam passion för hemmet och drivs av att vara en oberoende och självklar plats för människor att vända sig till vid de olika bostadsbehov som uppstår genom livet. Detta reflekteras i bolagets vision att vara nyckeln till din bostadsresa, där Hemnet med sina produkter och tjänster vill öka effektiviteten, transparensen och rörligheten på bostadsmarknaden. Hemnet är noterat på Nasdaq Stockholm (“HEM”).

Följ oss: hemnetgroup.se / Facebook / Linkedin / Instagram